Is cryptocurrency speculation one of the unintended consequences of blockchain technology?

- Christopher’s background is in user experience and technical communication, disciplines that research how to design user-friendly technologies to clearly communicate technical information.

- Terry’s background is in economics and public policy, fields that often examine technological innovation and its broader impact on society.

In addition, both of us have worked in finance for a number of years. Naturally, the innovation of blockchain—especially the unintended consequences of blockchain technology—has piqued our interest.

What follows is a primer we put together on what blockchain is … and what unintended consequences have come out of it, particularly cryptocurrency speculation. But before we get into cryptocurrency, let’s take a moment to explain the innovation behind it. What exactly is blockchain technology?

What is blockchain technology, in a nutshell?

Blockchains refer to networks of online databases that store permanent records of data or transactional information. These permanent records of transactions, called digital ledgers, exist on the blockchain.

Immutable transactions

One of the features that make blockchain unique is that its transactions are immutable. In other words, the digital ledgers are permanent records of every transaction that has ever taken place on the blockchain. Once on the blockchain, they can’t be changed or removed.

How do transactions become immutable on the blockchain? Simply put, blockchains replicate digital ledgers and distribute copies of them to thousands of computers (or network nodes).*

Hence, large numbers of computers store copies of the same transactional information (as opposed to accessing the data stored on a centralized server). This brings us to another feature that makes blockchain unique.

Decentralized networks

Instead of relying on intermediaries that let you make transactions (for example, a centralized entity, such as a bank or big tech company that administers a database), blockchains allow you to make transactions by automatically distributing copies of those transaction to computers around the world (a decentralized network that copies data across multiple nodes).

These networks illustrate the idea of decentralized finance (or DeFi). No bank or big tech company is necessary for transactions to occur on blockchain. Instead, there are multiple copies of everything on the blockchain that get distributed to computers worldwide. That allows individuals to make peer-to-peer transactions among themselves, without an intermediary.**

Plus, every time someone makes a transaction, the blockchain—and every single copy of that blockchain—gets updated on all the computers to reflect the latest transaction taking place.

Unintended consequences of blockchain technology

Interestingly, the features that make blockchain such a unique innovation have also given rise to some unintended consequences. One of the most conspicuous of these unintended consequences is cryptocurrency speculation. What’s cryptocurrency? Glad you asked.

Cryptocurrency, payments, and speculation

As the name implies, a cryptocurrency is a digital currency. (The word crypto in this context alludes to cryptography.) As such, cryptocurrencies are created through crypto mining, a process that verifies and adds cryptocurrency transactions to the blockchain. Then, the cryptocurrency can be accessed using a crypto wallet, which functions as a virtual bank account.

When you access a cryptocurrency, it’s possible to use it in a least two ways:

- Use it to buy goods or services online.

- Hold it and hope its value will increase.

Now, of these two possible uses, the latter appears to be more dominant.

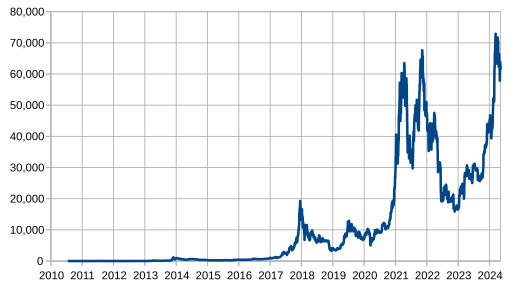

For instance, the majority of cryptocurrency transactions involve moving cryptocurrencies from one holder to another—as opposed to pricing or purchasing goods or services. As a result, most people seem to be holding them for currency speculation, which helps explain the extreme price volatility of cryptocurrencies. Maybe their volatility is no surprise, given that they’re unregulated currencies.***

Unfriendly access

To access cryptocurrencies on a blockchain, you need a username and password—a.k.a. public and private keys. In general, remembering passwords is a pain, but recalling private keys for blockchains is especially tortuous. They’re very long combinations of symbols that are impossible to guess. The public keys, meanwhile, are designed for pseudonymity. That is, they’re pseudonyms with no links to real names identifying users.

While these keys may seem like decent security measures, they’re not very user friendly. For example, what happens if someone forgets or loses their keys? Unfortunately, those users are out of luck and won’t be able to access whatever cryptocurrency they purchased. And if they can’t access their cryptocurrency, they’ve effectively lost their money.

Illegal activity

Moreover, the pseudonymity of people using these keys presents legal risks. For example, what if someone uses cryptocurrencies to fund criminal or terrorist organizations?

Financial institutions follow a variety of identify-verification policies, such as Know-Your-Customer (KYC) guidelines. Such policies and guidelines prevent criminals and terrorists from being able to fund illegal activities. In contrast, cryptocurrencies have no standard policies or guidelines to prevent those threats.

Privacy concerns

There are other concerns and risks with cryptocurrencies. Consider the issues of online privacy. Remember: blockchains create immutable transactions over a decentralized network. Again, they do so by distributing copies of transactions (digital ledgers) to computers (network nodes) around the world. With no intermediary, these immutable transactions—including cryptocurrency transactions—are publicly visible to anyone on the blockchain.

On one hand, the publicly visible of immutable transactions means that nobody needs to worry about their cryptocurrency transactions getting erased or deleted. After all, redundant copies of digital ledgers exist on countless computers. On the other hand, this public visibility and immutability means that advertisers may get access to anything on the blockchain—including every cryptocurrency transaction you’ve ever made.

That’s why cryptocurrencies could be a dangerous business technology when you think about surveillance capitalism: third parties that monitor our transactions online to manipulate what we see and buy on the web, without our knowledge or clear consent. The fact that people’s keys are pseudonymous wouldn’t prevent this problem. Even if users can’t be identified, they can still be monitored and manipulated online by third parties.

Cybersecurity risks

Besides privacy concerns, immutable transactions that are publicly visible involve cybersecurity risks, especially for cryptocurrency holders. For instance, anyone, including hackers, can look through cryptocurrency transactions and search for vulnerabilities in the blockchain coding. Specifically, there may be flaws in the coding that automatically executes instructions to send and receive transactions. These instructions are known as smart contracts.

Unfortunately, just as cryptocurrency transactions are immutable, the smart contracts that make those transactions possible are likewise irreversible. Like digital ledgers, smart contracts are permanent and unchangeable. Therefore, if hackers find a programming bug or loophole in a smart contract, they can exploit it. And they may very well exploit it to steal other people’s cryptocurrency.

Indeed, that’s what happened to Ethereum, a blockchain technology responsible for the cryptocurrency Ether. Hackers found a loophole in the programming and took off with millions of dollars in digital currency. That wasn’t the first hack on blockchain, and it certainly won’t be the last, given how vulnerable smart contracts are to hackers.****

Cryptocurrency speculation as one of the unintended consequences of blockchain technology

In pointing out cryptocurrency speculation as an unintended consequences of blockchain technology, we don’t necessarily mean to dissuade anyone from buying and holding cryptocurrencies. If you’re into currency speculation, best of luck to you!

If you’re not, however, keep in mind this takeaway. Although cryptocurrency businesses are marketing aggressively to get more and more people to buy into their digital currencies every day, you’ve reason to be skeptical about whether or not these virtual forms of money are a wise investment—at least while much of the hype is still sorting itself out.

Reference for learning about blockchain and cryptocurrency

Along with the linked info above, here are some helpful references to learn more about blockchain and cryptocurrency.

- Blockchain Explained – Investopedia

- Crypto: a beginner’s guide – The Economist

- A Guide to the World Bitcoin Created – Scientific American

- The Dawn of New Money – MIT Technology Review

- The future of cryptocurrency – The Vanguard Group

- What Is Web3 – LinkedIn

*Note: That’s why blockchain technology consumes enormous amounts of energy. Its data must be copied on network nodes all over the globe!

**Another note: For this reason, blockchain transactions are trustless: a concept that means nobody needs to put their trust in a centralized entity (acting as a third-party intermediary). Still, it deserves mention that users of blockchain are still putting their trust in something. In effect, they are trusting the code—or rather, the people who created the code.

***Yet another note: There’s debate about whether or not cryptocurrencies are currencies. So far, the volatility of cryptocurrencies makes them impractical for online purchases, calling into question their use as a medium of exchange, unit of account, and store of value. For instance, cryptocurrencies are generally not reliable for making payments, setting prices, or holding stable assets, even though there are thousands of cryptocurrencies now—Bitcoin and Ethereum being two of the most popular. In that light, buying cryptocurrencies may be more akin to speculation, not investing.

****One more note: Perhaps hacking threats (such as targeting vulnerabilities in smart contracts) wouldn’t be a problem for an immutable blockchain, as long as all the code is perfect from the start. But talk to any experienced web developer, and that person will let you know that’s rarely the case. Web development is an iterative process, in which upgrades and enhanced designs are continually and periodically released.